Embracer Group is hosting its annual general meeting of shareholders, and CEO Lars Wingefors discussed the current restructuring and future initiatives to continue it.

Wingefors started his presentation by mentioning that Embracer now owns well above 100 game development studios and more than 800 IPs.

He also added that he firmly believes that the company's decentralized model empowering entrepreneurs and creators is the best model to drive profitable growth.

Yet, he admitted that the fiscal year 2022/23 (which ended in June) was a challenging year for the whole industry and specifically for Embracer, which suffered from delays and a deal that did not materialize.

The company's financial results are deemed "not nearly as strong" as expected at the beginning of the year, mostly due to the PC and Consoles operating segment.

The segment showed solid organic growth, but lower margins due to delay, lackluster releases, and weaker purchasing power affecting consumers.

The top revenue drivers among PC and console games for the year were Saints Row, Valheim, Goat Simulator 3, Deep Rock Galactic, and Star Trek Online.

Wingefors went on to mention that Embracer has invested in one of the largest pipelines across the industry. Looking ahead they remain focused on executing on that pipeline, partnership approach, and efficiency improvement initiatives.

He's "confident that Embracer will come out stronger" despite having to take difficult decisions.

Later in the presentation, Wingefors mentioned that this is the most challenging time of Embracer's history and the company is adjusting to the new reality.

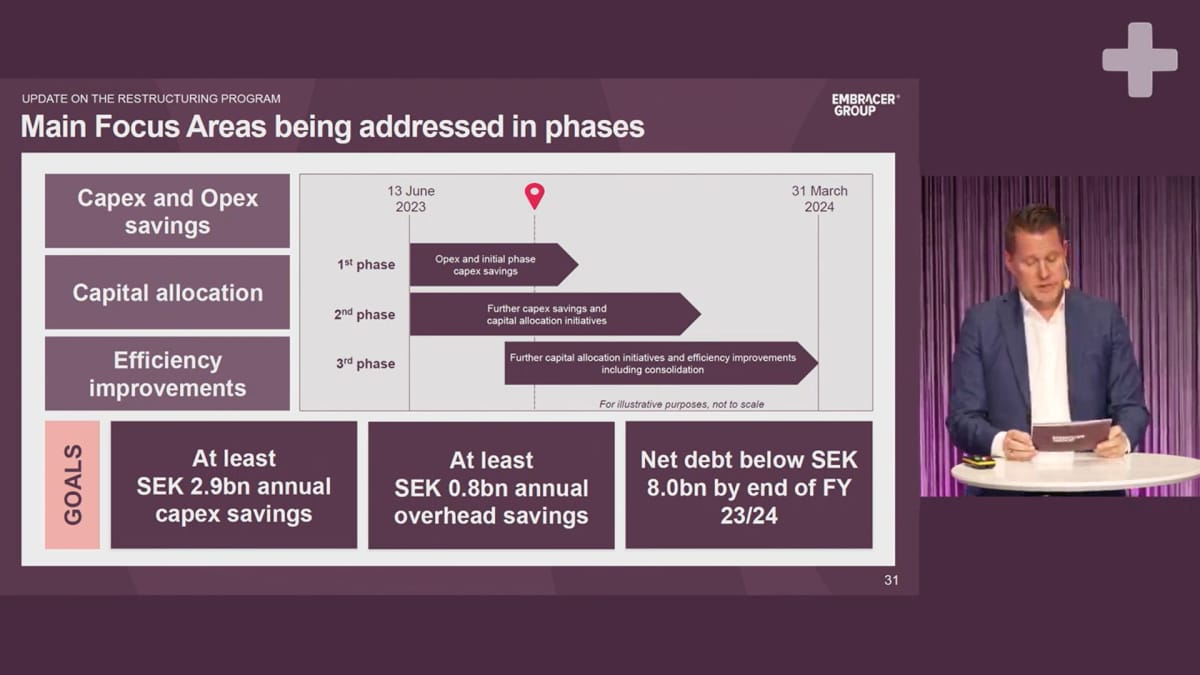

He added that the company needs to continue making tough decisions following the restructuring program initiated in June.

That being said, Embracer had a "great start for this fiscal year" which gives Wingefors and the management team "great confidence that they will deliver what they set up to do."

They intend to see growth for the years to come driven by a more focused pipeline of investments.

During the Q&A segment, Wingefors explained that the restructuring program is tough, but the company is determined to deliver on it.

Preferably, he would like to find new opportunities for affected employees even if it's outside of Embracer, potentially through divestments.

There is also the possibility to work with partners to finance some projects in order to avoid having to lay off employees.

That being said, ultimately Embrader is making decisions to restructure and downsize some teams, and there will be "a few cases of closures."

He added that on the divestment side, there is a strong and vibrant market with many active players - both financial sponsors and big industry players - but it's easier to run proper processes for higher-value assets than smaller assets.