In a presentation to Stakeholders this week, Sony CFO Kenichiro Yoshida explained the company's consolidated financial results for the second quarter (ending September 30th) 2016. Sony declared a 32.8 Billion Yen operating loss for the quarter and an additional 4.5 Billion in income tax expense in relation to the transfer of their battery manufacturing business to Murata Manufacturing Co. As a result, Sony has revised their forecast on consolidated operating income for the year down 30 Billion to 270 Billion Yen.

Looking at the year-on-year figures, consolidated sales fell 11% from 1 trillion to 688.9 Billion and operating income decreased 48% to 45.7 Billion Yen. This includes approximately 13.7 Billion Yen attributable to losses arising from April 2016's Kumamoto Earthquakes. The figure is approximate as it takes into account 'opportunity losses' - theoretical costs arising from a loss of potential business or operations. Net income from Sony Corporation Stockholders also decreased 86% to 4.8 Billion Yen, though this is generally considered a positive sign as lower investment from stockholders points to a business relying on more efficient revenue streams.

Before breaking down the results by market segment, Sony made a short statement regarding the recent misconduct exposed at Sony's semiconductor manufacturer Sony LSI Design Inc. in which five former employees, including a former executive, were found to have defrauded the company with fictitious orders worth around 900 Million yen. Sony issued an apology to anyone affected and advised they are considering pursuing criminal and civil charges against the former employees involved.

[scribd id=329967940 key=key-cZ0irtCp6V7E8wX8nI41 mode=scroll]

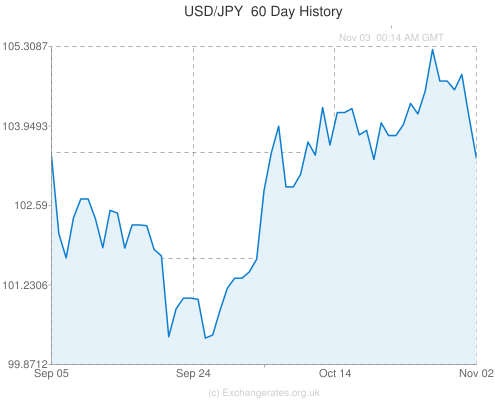

The PDF above contains the full set of results, including breakdowns by market segment and half-year comparisons as well as the quarterly comparison. The main areas showing significant decline year-on-year are the semiconductor and components segment (which includes the previously mentioned battery business). Conversely, areas like Motion Pictures, Mobile Communications, and Music have seen growth. Yoshida explained in his presentation that many of the declines are, in part, due to unfavorable fluctuations in the value of the Yen over the quarter.

We have provided a short segment-by-segment review of Sony's results below in an attempt to simplify some of the information provided and analyze what these results may mean for Sony.

Mobile Communications

Sales decreased by 40% year-on-year, mainly within the mid-range smartphone segment, performing particularly poorly in Europe. Yoshida freely admits in the presentation that the Spring product lineup did not 'meet the needs of the market.' Despite the decrease in sales operating income improved by 24.3 Billion, changing the year-on-year results from a 20.6 Billion loss to 3.7 Billion Yen profit. This is primarily due to increased cost efficiency on Sony's part having led to a huge increase in profitability of units sold. Sales forecasts in this segment have been revised down, but income forecasts remain the same as lower overall sales are expected to be offset by the cost reductions and sales of Sony's flagship model the Experia XZ.

Gaming and Network Services

Operating income decreased 4.9 Billion year-on-year and sales were down from 360.7 Billion to 319.9 Billion Yen, though the segment is still profitable. Several factors have had an effect on these results. First, the primary reason for the decrease is that this segment includes the price drop on the PS4 base units, but obviously does not yet include the new PS4 Pro hardware which is expected to offset this. Sony states that the negative impact of the price drop has been mitigated in part by cost reductions in the manufacture of the hardware. The appreciation of the Yen is again cited as a factor. On the positive side, network revenues continue to increase (31% year-on-year) and sales of PS VR hardware are reportedly 'on track.' Sony appears confident this will balance out over the year and has not adjusted its forecasts in this area.

Imaging Products (Cameras and Sensors)

Year-on-year sales have decreased 25% for the period, though offsetting through cost-reduction and other factors mean operating income has only decreased 8.2 Billion to 14.8 Billion Yen. This can partially be attributed to the aforementioned currency appreciation as well as 3 Billion of direct losses incurred to manufacturing due to the Earthquakes. A quicker than expected recovery from the Earthquakes means that the operating income forecast for this segment is increased to 34 Billion Yen.

Home Entertainment & Sound

Year-on-year sales have decreased 19%, but operating income increased to 17.6 Billion Yen. This is a strongly positive result as it indicates that negative impacts from currency appreciation have been completely overturned. Sony cites the improvement in sales of high-profit-margin models and cost reductions as reasons for this. The company has increased operating income forecasts here by 6 Billion, with Yoshida stating that T.V. sales have been particularly strong in the first half of the year.

Semiconductors

A large year-on-year deterioration was reported in the semiconductor business. Sony recorded an operating loss of 4.8 Billion for the period, down 38.2 Billion year-on-year. This area has been affected by many negative factors; currency appreciation, inventory write-downs, and inventory surplus all contributing. Loss for the year is forecast at 53 Billion, though this is an 11 Billion reduction in loss from previous forecasts. This does apparently rely on Sony's assumption that they will be able to liquidate 20 Billion Yen in surplus stock. Strong demand in the Chinese market and lower impact of Earthquake related costs make this potentially achievable. Yoshida also stated that they expect this market to improve going forward with Drones, surveillance, and automotive sensor markets all expected to show improvement in 2017.

Components

Having been significantly affected by the ongoing transfer of Sony's battery business, sales have decreased 24% for the period and an operating loss of 36.6 Billion Yen was reported (32.8 Billion related to the transfer.) The transfer will continue to affect this segment into 2017 and forecasts have been adjusted down to an operating loss of 48 Billion Yen.

Pictures

Sales have increased 5% for the period, and operating income increased 25.7 Billion to record a 3.2 Billion Yen profit. Theatrical revenues from motion pictures have been credited for the result. Forecasts on operating revenue have been adjusted down for the year, however, to 29 Billion Yen as these figures were lower than expected. Sony report that Motion Pictures are progressing well as a market segment and re-iterate that the appointment of a new CFO for Sony Pictures Entertainment means they can 'further enhance financial discipline.

Music

Sales and Operating income increased year on year due to higher sales of recorded music, among other factors. It is important to note that this segment also includes ad related and subscription revenues, which means mobile game Fate/Grand Order's recent success is also a factor here. 16.5 Billion Yen of operating income was reported for the period and forecasts in this area remain unchanged.

Lastly, Sony Financial Services continue to operate in profit, though at a slightly lower level than previously recorded. Operating income decreased but was still reported at 33.6 Billion Yen.

The results, while not fantastic for Sony, are not an immediate cause for panic. For a hardware manufacturer operating in several different business areas, quarterly results tend not to present a full picture of the company's relative success or failure. Several external factors have contributed to the recent set of results and Sony's response to these, especially in regard to how it can mitigate the effect of currency values on operations, will be an important factor going forward. Yoshida did address this in his presentation, advising that Sony will look at the possibility of localizing more processes such as logic and semiconductor manufacture. A focus on high-margin sales outside of Japan could also help to mitigate a predicted 63 Billion Yen negative effect.

It appears that the biggest challenge facing Sony as an overall business group is how to manage its more significant loss-making interests. The transfer of the battery business indicates a step toward this, as does setting up Sony Semiconductor Solutions as a separate entity. Perhaps the biggest plus from our, and many of our readers', perspective is that the Gaming and Network sector continues to perform strongly. The facts and figures are available in the PDF above, and you can get the full investor handouts directly from Sony here. If you have any more specific questions about the quarterlies, I will do my best to answer anything posted in the comments section.

As a stakeholder, how do these results look to you the customer? good, bad, totally incomprehensible? Let us know your take on the results in the comments below.